The late-week rally we experienced last week was likely being fueled by short-covering rather than speculative buying.

Nothing has changed in the fundamentals to turn the energy complex bullish in the last several days.

Oil remains under pressure and will continue to be for a little while, as world economies are attempting to reopen very slowly in the United States and Western Europe, although resumption in China still remains further down the line.

With May 1 approaching fast, the big question is how will the supply side deliver?

Prices could continue to firm up for this week if more OPEC+ members announce early production cuts.

An escalation of military activity in the Middle East would also be a driving factor for high prices.

However, the wildcard will be the announcement of oil output cuts made by the United States oil producers.

This news could potentially trigger a steep short-covering rally.

The demand destruction is expected to continue, but may slow down a bit if the COVID-19 curve continues to flatten.

Once the coronavirus is under control, output should rebound as well as prices, but don’t expect output or prices to return to pre-virus levels for quite some time.

Rising Tensions In The Middle East Threaten Supplies

After June futures hit $6.50 per barrel and the nearby futures contract went off the board, prices rose in reaction to an announcement from President Donald Trump in which he instructed the United States Navy to fire on any Iranian ships that harass them in the Gulf, although he added later he was not changing the military’s rules of engagement.

This ratchets up tensions once again between the United States and Iran.

However, given the glut we have in the oil market, it is difficult to see this offering lasting support to the market, unless the situation does escalate further.

From A Purely Technical Perspective…

Look out for a strong bullish upside bias to develop on a sustained move above the $20.00 price area…

And look out for a strong bearish downside bias to continue on a sustained move below the $15.00 price area.

April Crude Oil YEARLY Cycles

- The 10 year cycle makes a high on April 15, then pulls back into April 19 then makes a major top on May 2.

- The 20 year cycle makes a major low on April 11 then rallies into the April 25.

- The 30 year cycle continues its sell off into April 18 then rallies into the end of the month.

April is the second most bullish month of the year for crude oil.

With that said, there’s really no clear correlation to support that statement.

But, there is a seasonal tendency for oil prices to rally during the latter part of this month.

Key turning point dates:

- April 3

- April 16 to 17 – close to 10 and 30 year cycles

- April 23 to 24 – close to 20 year cycle

Long-Term MONTHLY Price Outlook

The $12.00 price area can potentially absorb annual selling pressure, above which the $30.00 price area remains a several week target, the $57.00 price area is potentially in reach over the next several months.

Upside, the $30.00 price area can absorb buying pressure through May trading sessions, a daily settlement above the $30.00 price area indicates a good annual low has been placed.

Then the $57.00 price area becomes a several month target where the broader market can potentially place this calendar year’s high.

Downside, a daily settlement below the $12.00 price area will most likely yield a $1.00 price area test within several days to follow, the lowest price support presently found on any chart.

Further downside action would likely result in another negative price retest like we saw during the last week on the CLK20 expiring contract.

Mid – Term WEEKLY Price Outlook … 4 / 27 – 5 / 1

The main trend remains bearish according to the weekly swing chart.

A trade through the $6.00 price area will signal a resumption of the downtrend.

The main trend will change to bullish on a trade through the last main top at the $55.00 price area.

However, this is extremely unlikely.

The minor trade range is between the $34.00 price area to $6.00 price area.

It’s 50% level or pivot point is at the $20.00 price area.

The short-term trade range is between the $55.00 price area to the $6.00 price area.

It’s 50% level comes in at the $31.00 price area.

The main trade range is the $64.00 price area to $6.00 price area.

It’s 50% to 60% retracement zone which is between the $35.00 price area and the $42.00 price area serves as a major price resistance.

Weekly Technical Forecast

Based on last week’s price action, the direction of the June WTI crude oil futures contract for the week-ending May 1 is likely to be determined by trader reaction to a downtrending angle at the $15.00 price area.

Weekly Bullish Scenario

A sustained move over the $15.00 price area will indicate the presence of buyers.

If this move creates enough upside momentum then look for a surge into the minor pivot at the $20.00 price area.

Since the main trend remains bearish, sellers are likely to come in on the first test of this level.

In attempts of the bears trying to overtake it, could potentially trigger an acceleration to the upside with the next major target coming in at the $31.00 price area.

Weekly Bearish Scenario

A sustained move under the $15.00 price area will signal the strong return of sellers.

The daily chart indicates there is plenty of room to the downside with the next downtrending target angle coming in at negative price areas.

Short – Term DAILY Price Outlook … April 28, 2020

For Tuesday, the $12.00 price area remains a long-term support level that can absorb not only daily selling, but also selling pressure throughout the balance of May’s trading activity as long as the market continues placing weekly and monthly settlements above the $12.00 price area.

Upside today, the $17.00 price area would most likely contain initial strength, beyond which the $19.00 price area is able to contain the balance of the session’s strength.

A settlement today above the $19.00 price area indicates potentially reaching the $22.00 price area within several days and a next $30.00 price area target could then potentially be within reach by the end of next week.

Downside today, opening / breaking below the $12.00 price area allows a further fall to the $11.00 price area intraday.

A weekly settlement today below the $12.00 price area critical support will likely allow for further bearish downside back into the single digit prices again, potentially as low as the $1.00 price area by the week’s end.

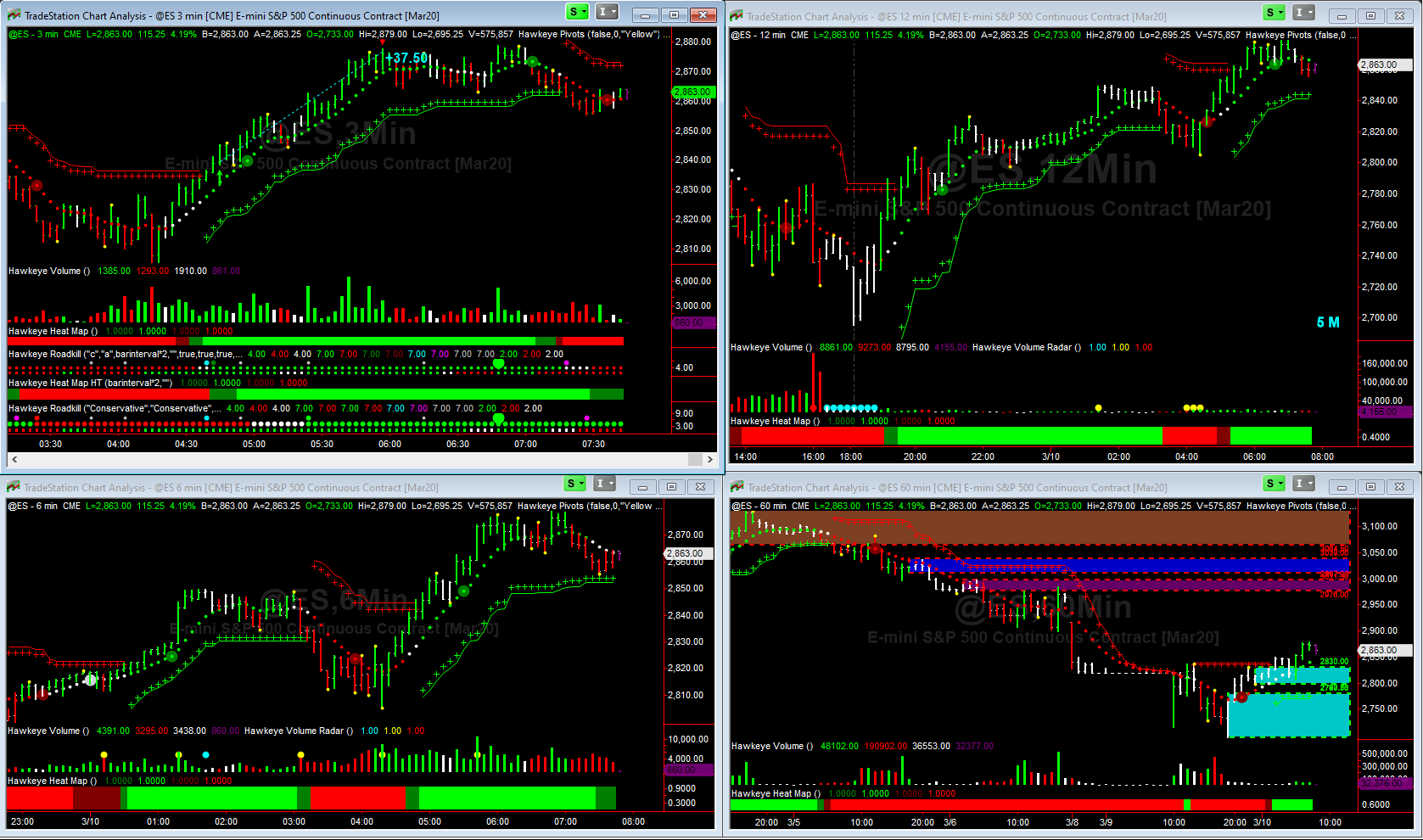

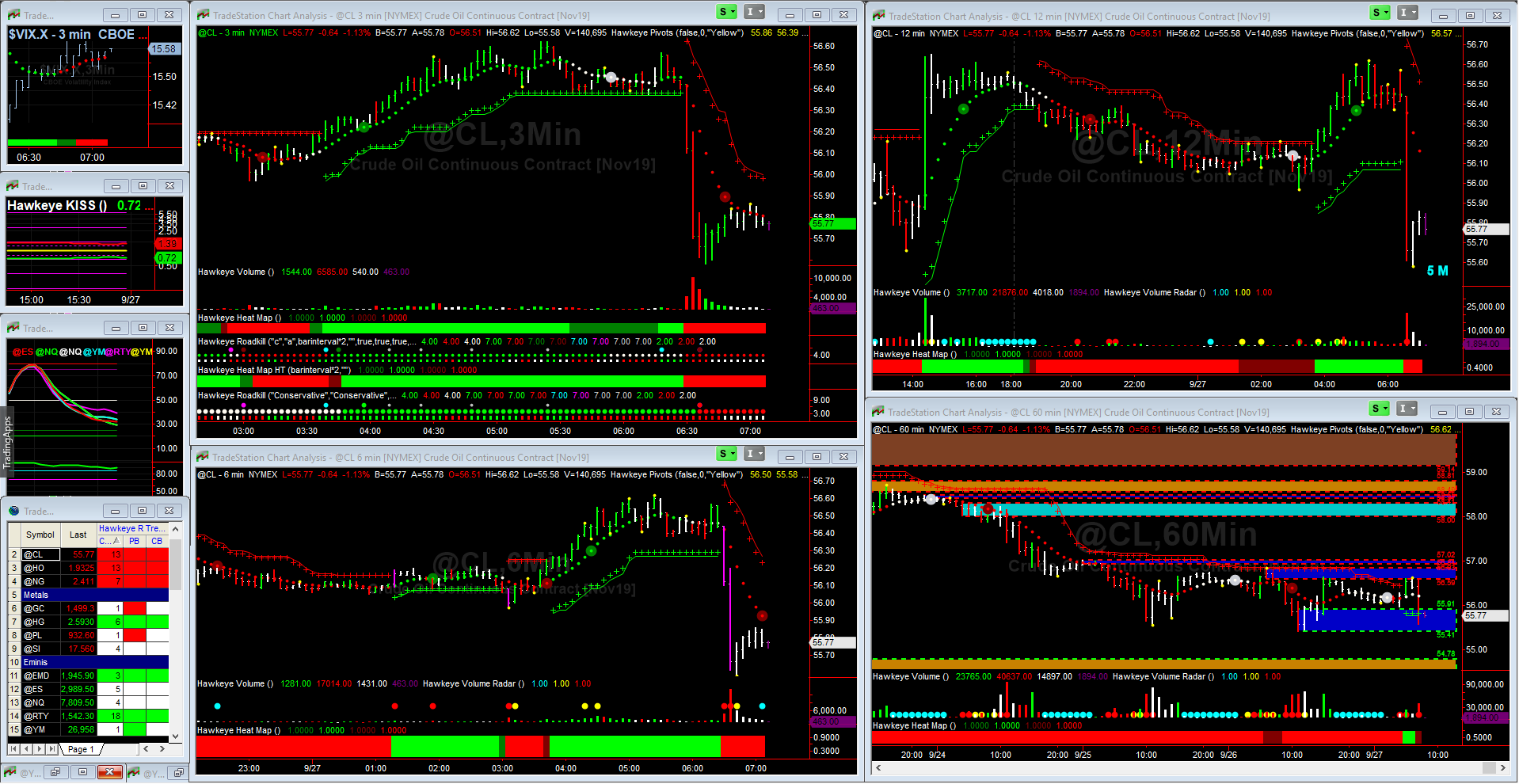

Let’s reflect on Monday’s charts above.

The price action on the 240 minute chart(s) exited congestion during the pre-market hours on Monday morning on the currently traded and 2 future expiring contracts.

A successful retest of the $12.00 price area held prices from falling further.

Today’s closing price on the closest expiring contract CLM20 was $12.93.

Fresh Hawkeye Demand Zone(s) on the 240 / 480 / 960 Minute and Daily Charts all held selling pressure from falling further during Monday’s trading session.

Confluence among Hawkeye Supply and Demand Zones stacks the odds in our favor of predicting price action and are key for establishing price targets.

The Zones on the 240, 480 & 960 Minute charts all presented clear target(s) to have taken a short position when price exited congestion on the 240 chart.

While there is clearly a bearish sediment in the market, the $12.00 price area remains a key area to hold and resume closing above in order to avoid retesting single digit prices again.