by Guest Columnist, Kenneth Reid, Ph.D

Greetings Hawkeye traders, this is Dr. Kenneth Reid from HawkeyeMindset.com

In this article I’d like to discuss what I call The Money Trap… what it is, how to avoid it and the empowering state of mind you can achieve, if you succeed.

[This article is a summary of a video I produced with a special soundtrack that facilitates whole brain learning. You can download the video here]

As some of you may already know, I have a Ph.D. Clinical Psychology and I’ve been a trading coach for 16 yrs. I’m an active trader myself (stocks and futures) and I’ve been a Hawkeye user since 2007.

Whatever market or markets you trade, volatility ‘mean reverts.’ In other words, it oscillates from low to high and back again. During periods of high volatility even experienced traders tend to over-focus on their P&L because it fluctuates so much.

But once we start obsessing about money, we are already in The Money Trap.

HOW THE MONEY TRAP WORKS

The Money Trap in trading is like scoreboard pressure in sports. It’s the pressure athletes feel during the last few minutes of a close game… or at a key moment where winning the very next point is crucial.

In trading, however, the game never ends… unless we end it. And because we are putting capital at risk, each and every trade has “scoreboard” significance.

The Money Trap has us when we adopt these four internal Imperatives:

Don’t…

- be wrong!

- miss out!

- lose money!

- give back gains!

Many aspiring traders are caught in The Money Trap all the time, when they are trading a live account. These four (negative) imperatives are constantly running through their mind as they try to trade. And that’s a problem.

WHY YOUR BRAIN WORKS AGAINST YOU

Whenever our security becomes an issue… as it does when we constantly focus on money… our brain automatically goes into survival mode and constricts our field of mental and visual focus.

No matter how much screen real estate you have, the pressure to be right, not miss out, not lose, and not give back gains results in… tunnel vision. At critical moments, you will be gazing at an area of your screen about the size of a quarter!

This is why, when you look back over your trades later, you realize that you missed the obvious. (Maybe you were short when you should have been long… or vice versa.) But it’s even worse than that.

When your finger is on the mouse and you are hyper-focused on the price bars as they form, do you think you will remember to follow your trade management rules?

Brain research suggests the answer is ‘No.’

When we feel survival pressure, our prefrontal executive function is bypassed in favor of a faster circuit near the brain stem. That’s our reptilian brain… not our slower, more reflective human brain. So bye bye Hawkeye trading plan.

With your Lizard Brain in charge, you might cut your winners short, or chase price, or move your stop, buy high, sell low, double down or just freeze… all without actually thinking.

So how can you avoid The Money Trap; how can you stop your Lizard Brain from hijacking your trading?

THE SOLUTION

Fortunately there’s an effective solution. Let me give you an example from the world of elite sports because it applies to trading, too.

Have you noticed that the quality of athletic performance in certain Olympic events has increased dramatically over the last few decades?

In the 1980s a diver could make the Olympic team with a 1 ½ somersault. But in 2016 Michael Hixon needed to execute a perfect forward 4 ½ to qualify for the Rio Olympics. How was so much improvement even possible?

20th Century coaching culture was 100% focused on Outcome… on winning. Vince Lombardi summed it up: “Winning isn’t everything, it’s the only thing.”

In the 21st Century, however, peak performance coaches turned that success formula inside out. They realized that Outcome is beyond one’s control. So they began to encourage athletes to focus on Process not Outcome.

By not focusing on results, athletes had less stress. Less stress meant less “choking” and better adaptation to the circumstances at hand. Remarkably, athletes began to experience a peak performance state you may have heard of called ‘FLOW.’ And this was a game changer. These athletes had an edge few could compete with.

‘FLOW’ FOR TRADERS

In trading, the outcome of any particular trade is not only out of our control, it’s also randomized. According to Mark Douglas: “There is a random distribution between wins and losses for any given set of variables that define an edge.”

If you have a method with a 70% win rate, the 30 trades out of 100 that are losers will be randomly distributed in the time series. You can’t know in advance when they are coming.

If the Outcome of any particular trade is randomized by the market gods, does it make sense to adopt imperatives that imply we should attempt to control it?

Probably not.

In trading we have a choice… focus on Outcome (something we can’t control) or focus on executing our trading Process (method), which we can control.

Here’s the key point: cultivating a Process Mindset is the most effective way to reduce (even eliminate) the most common trader fears:

The Fear of:

- Being Wrong

- Missing Out

- Losing Money

- Giving Back Gains

Take a moment to imagine what it would be like for you to trade without fear. That’s the state of FLOW.

I’d like to leave you with the following question: What if creating and maintaining that state of mind became your primary goal as a trader?

(I’ll have a follow-up article next week. Until then, good trading and may the flow be with you!)

Join us in the next free LIVE Hawkeye Demonstration Room held every Wednesday at 9.30am EST US. You will learn more about volume and volume price analysis and see more examples and live trade setups. It is open to all.

Click this link for more information or to join us in class.

Learn to trade the Hawkeye way.

Good trading,

Randy Lindsey

Hawkeye Traders, LLC

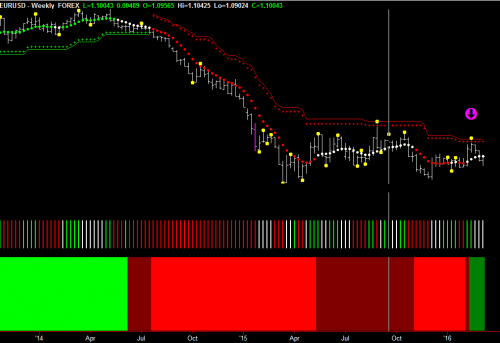

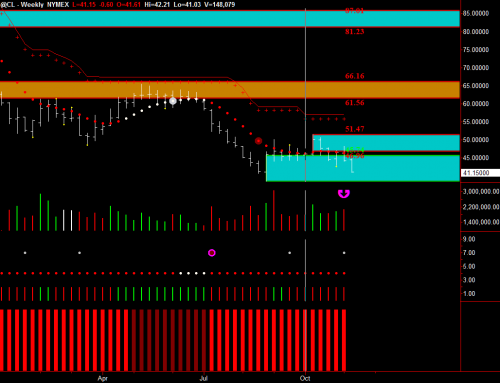

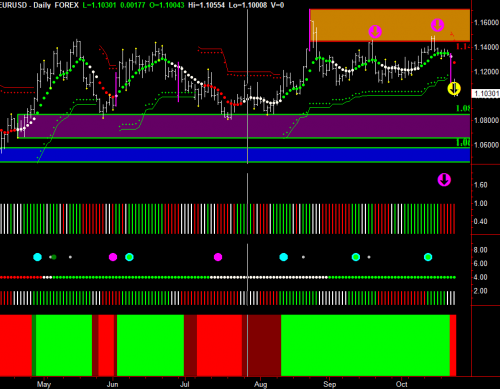

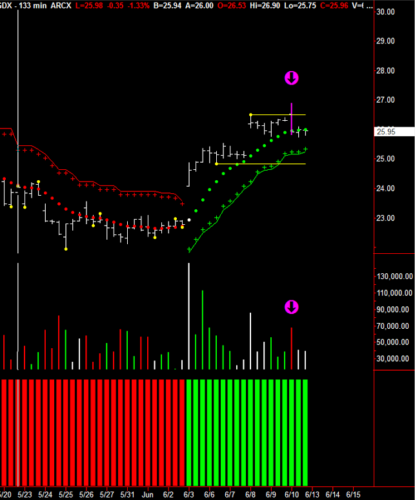

We’re starting to see the possible resurrection of a little inflation. The Eurozone just reported a 1.8% rise in consumer prices while we’re hitting 2.1% in the U.S. The Wall Street Journal chimed in:

We’re starting to see the possible resurrection of a little inflation. The Eurozone just reported a 1.8% rise in consumer prices while we’re hitting 2.1% in the U.S. The Wall Street Journal chimed in:

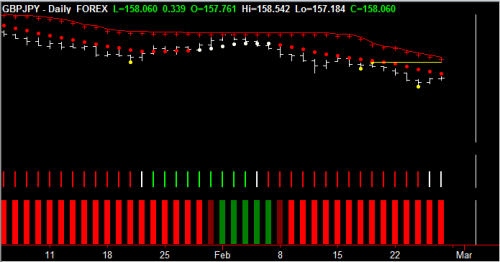

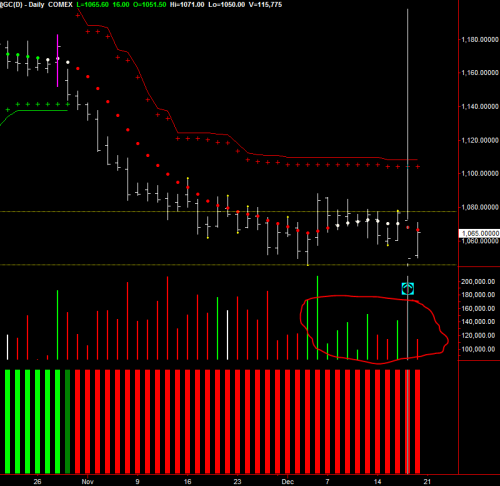

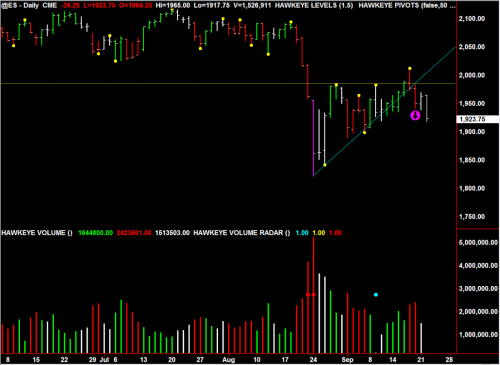

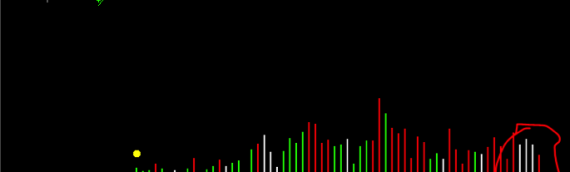

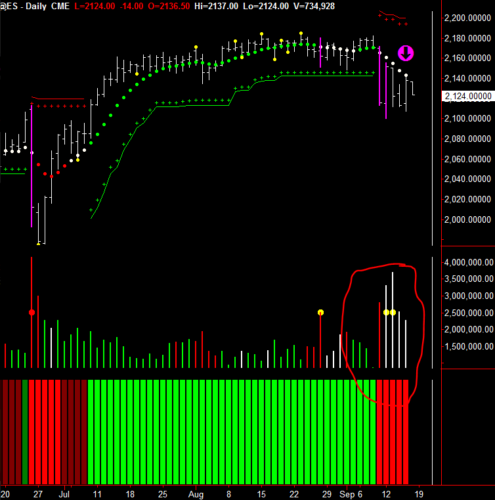

Great short at 10.00am Eastern.

Great short at 10.00am Eastern. Another great short at 05.30am Eastern.

Another great short at 05.30am Eastern.