Trending Market Strategy: Nearly 900 Tick NQ Rally Identified On Hawkeye Congestion Exit Setup

Anthony Speciale here with Hawkeye Traders. I hope everyone is having a phenomenal day as we witness record highs on the NASDAQ and the S&P 500.

It’s an exciting time, and today, I want to share some valuable insights on how you can approach a strong trending market.

When the market is trending strongly, it’s natural to feel uncertain. You might think, “The market can’t go any higher, can it?” and start wondering if you should short it.

Conversely, in a downward market, you might think, “Maybe this is the bottom,” and consider going long. This mindset can lead to trouble.

As someone who has worked with traders for many years and overcome my own hurdles, I’ve learned that when the market is trending, it is often exhibiting momentum.

Think of it like rolling a ball – it will keep rolling until it encounters resistance or support.

As long as market participants don’t see the market as overpriced or underpriced, there’s a better chance of success by trading with the trend rather than trying to pick the session high or low.

Attempting to pick highs and lows can shift your mindset from trading to gambling, which is dangerous.

In gambling, the odds are against you. If you approach the market with consistency and discipline, employing your personal trade plan, you shift the odds in your favor.

This is the difference between gambling and trading.

In a strong trending market, there’s a better chance that the market will continue in its direction rather than reversing suddenly.

I’ve experienced this firsthand. In my early career, I tried picking highs and lows, but as I learned from my losses, I started waiting for clear patterns before making my move.

It’s better to be slightly late to the right party than early or on time to the wrong one.

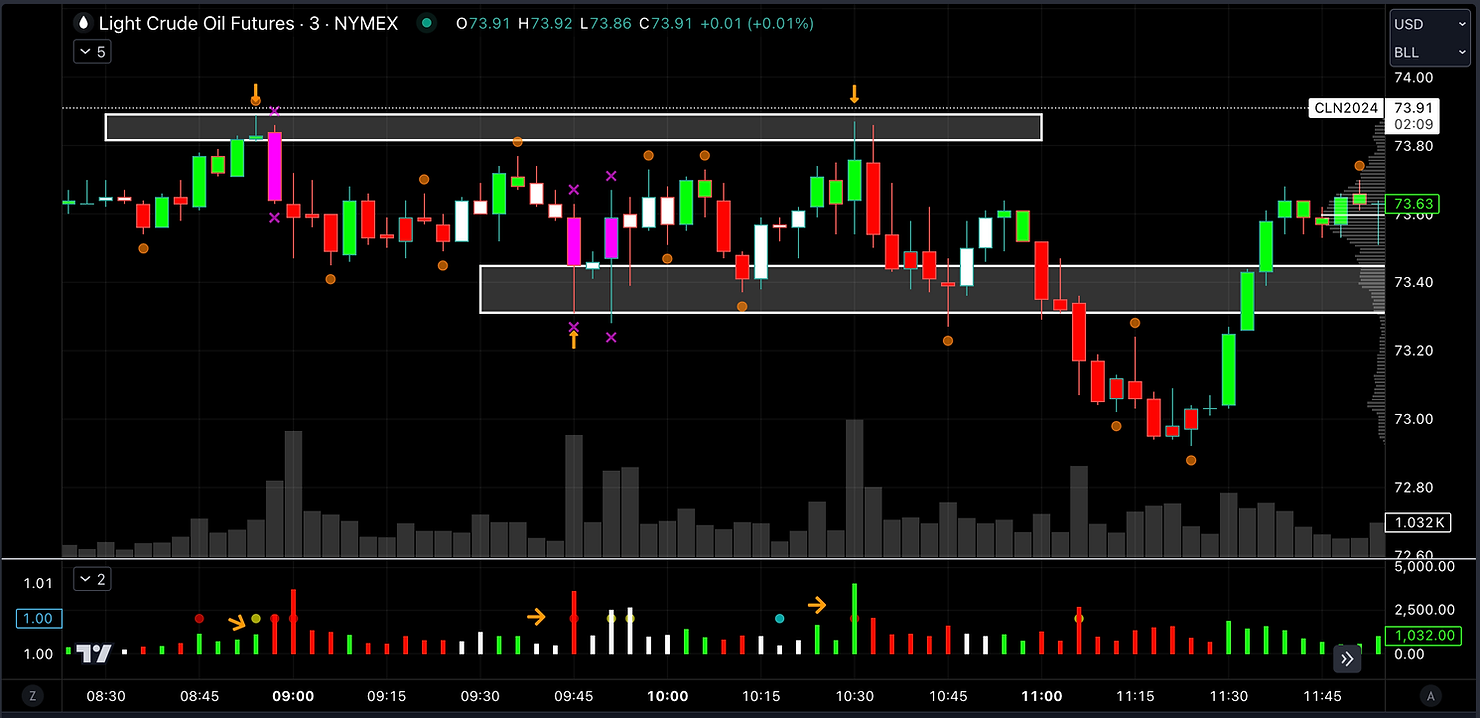

Let’s dive into a practical example using the NASDAQ. Today, I want to focus on the Hawkeye Wide Bar. This tool is particularly useful in strong trending markets.

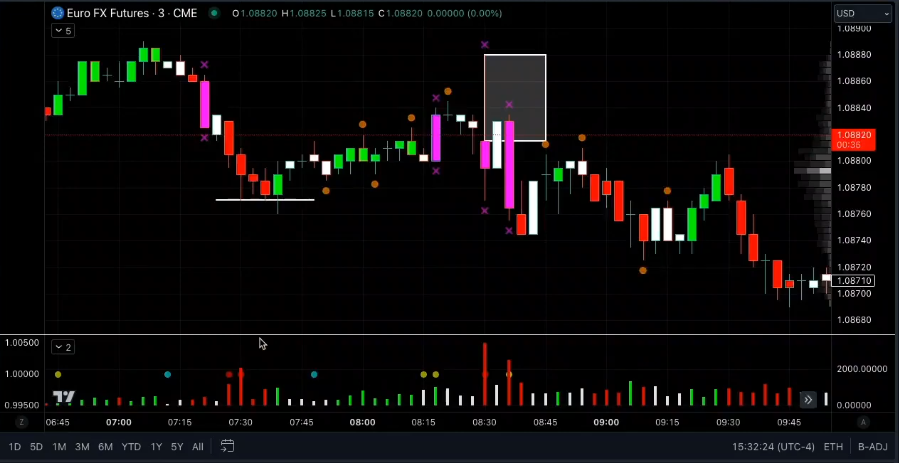

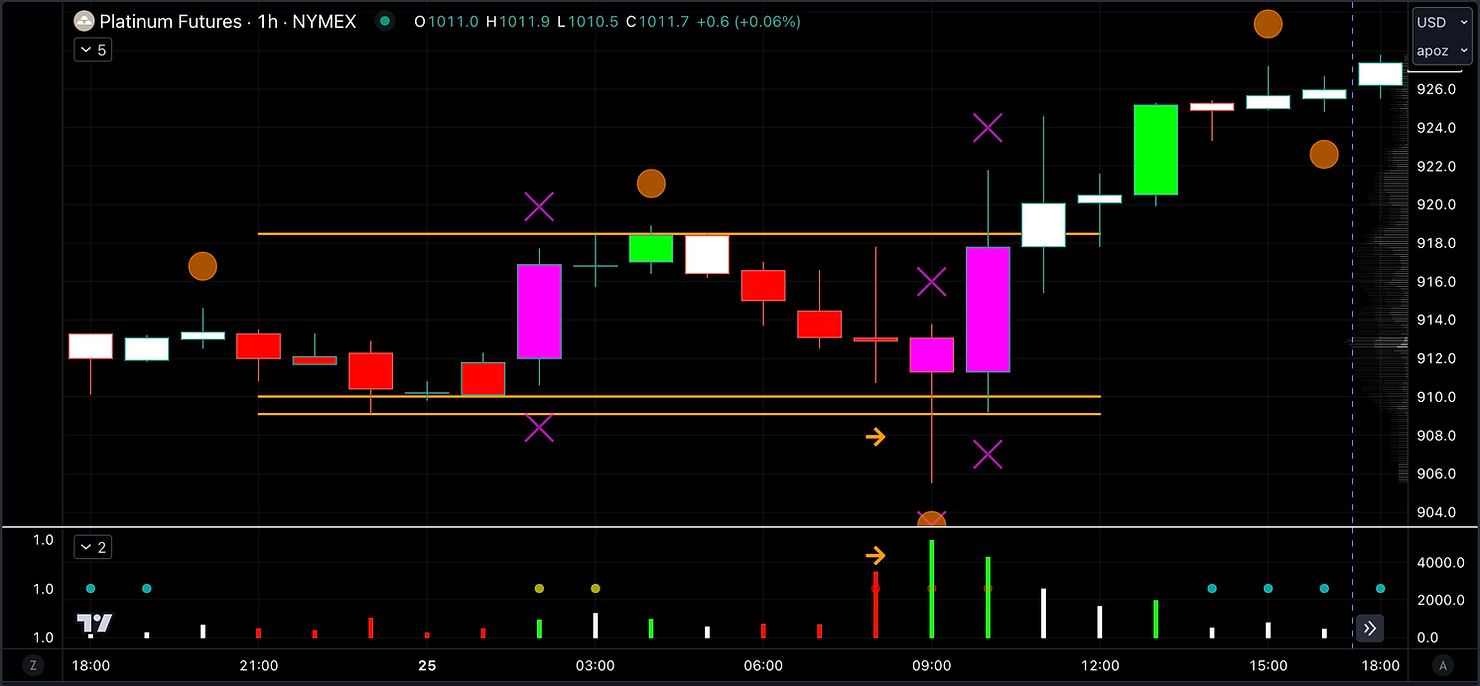

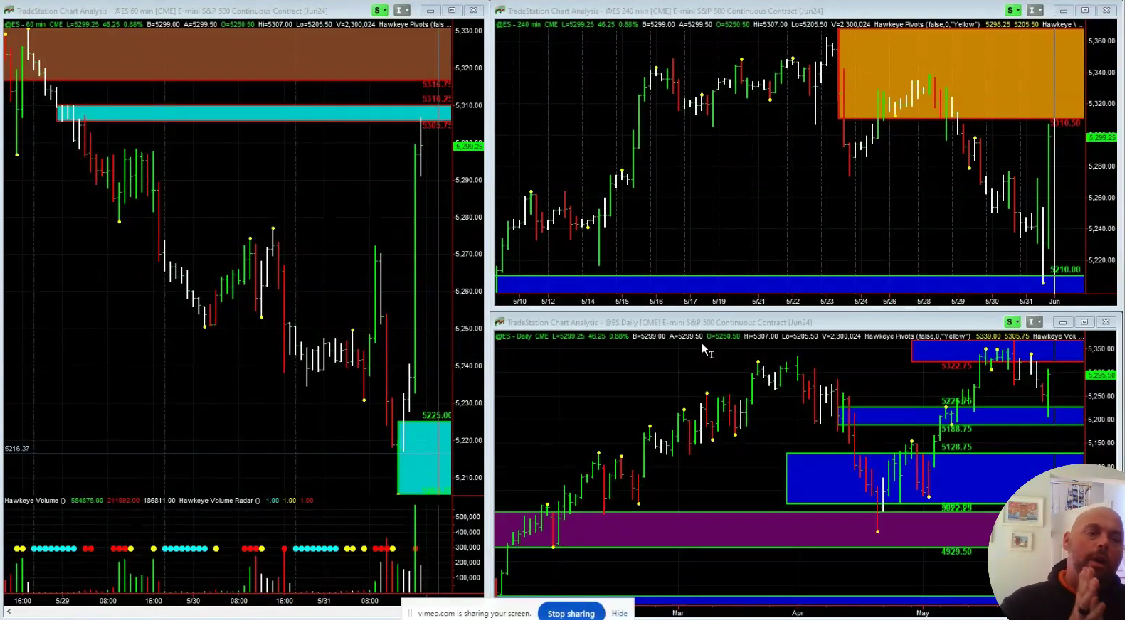

We’re looking at the NASDAQ 100 E-mini Futures on a 5-minute chart, using the Hawkeye Volume, Paint Bar, Wide Bar, Pivot, and Radar Dot indicators.

In a trending market, I pay special attention to the Wide Bars, marked in magenta.

When a Wide Bar appears, I draw lines at its high and low.

This helps me identify potential support and resistance levels. For instance, if the market consolidates and then closes above a Wide Bar, that bar becomes support.

Let’s look at an example. We had a Wide Bar that formed, and the market consolidated above it before rallying over 720 ticks.

This confirms the continuation of the trend. Similarly, another Wide Bar later in the day marked the high of the session, providing resistance.

Using these tools, you can make informed decisions about when to enter and exit trades. It’s crucial to wait for confirmation and not rush into trades.

The Wide Bars, along with volume analysis, give us the insights needed to navigate the market effectively.

If you’re not using Hawkeye Tools, I encourage you to consider them. They provide a clear and concise way to analyze the market, helping you make better trading decisions.

Additionally, our Hawkeye Volume and Price Action Mastery Library offers comprehensive education on how to use these tools effectively.

I invite you to access our resources, and reach out to our team with any questions.

We’re here to help you fine-tune your trading approach and achieve trading success!

Happy Trading,

Anthony Speciale

Hawkeye Traders

Big Energy Profits

![[LIVE] Calling Session High: Identifying 2024's YTD Largest Broad Market Sell-Off](https://www.hawkeyetraders.com/wp-content/uploads/2024/05/5.26-2.png)

![[LIVE] Calling Session High: Identifying 2024's YTD Largest Broad Market Sell-Off](https://www.hawkeyetraders.com/wp-content/uploads/2024/05/5.26-1-1024x473.png)

![[LIVE] Calling Session High: Identifying 2024's YTD Largest Broad Market Sell-Off](https://www.hawkeyetraders.com/wp-content/uploads/2024/05/5.26-2-1024x477.png)

![[PLUG] Plug Power Inc.: LIVE Trade Case Study](https://www.hawkeyetraders.com/wp-content/uploads/2024/05/5.21.png)

![[PLUG] Plug Power Inc.: LIVE Trade Case Study](https://www.hawkeyetraders.com/wp-content/uploads/2024/05/5.21-1024x475.png)

![[XOM] Exxon Mobil Corporation: LIVE Trade Case Study](https://www.hawkeyetraders.com/wp-content/uploads/2024/05/5.20.png)

![[XOM] Exxon Mobil Corporation: LIVE Trade Case Study](https://www.hawkeyetraders.com/wp-content/uploads/2024/05/5.20-1024x475.png)