To trade the US Dollar, you need to know this. Last week Hawkeye showed no-demand volume, the first sign of distribution in an uptrend. Since then the market price profile has confirmed this setup with a trend pause and no-demand volume. This is a classic set up working through. Today let's looks at how low volume can prefigure an accumulation phase.

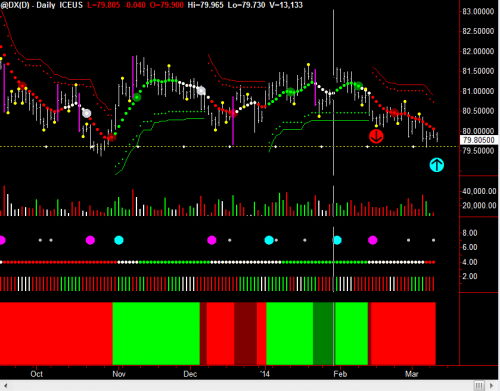

Daily US Dollar Index (DX) Chart

The US Dollar Index has been in downtrend for some weeks but we are at a pivotal point on the daily chart. Look at where the great short came in on 14 February (indicated by the red arrow) and is showing 80+ pips. However, look at the low volume under the cyan arrow. Remember this is the first sign in your forensic analysis that the market should be commencing its accumulation phase prior to uptrend. So, if you are short pull your stops in.

Note: the red and cyan arrows are placed for illustration only, and are not part of the software.

Hawkeye Perspective

If the close by the end of week is under the dotted line on increasing volume all bets are off and the downtrend will continue. Learn to trade the US Dollar using Hawkeye indicators.

Join Randy in the next free LIVE Hawkeye Demonstration Room held every Wednesday at 9.30am EST US. You will learn more about volume and volume price analysis and see more examples and live trade setups. It is open to all.

Click this link for more information or to join us in class.

Learn to trade the Hawkeye way.